how is capital gains tax calculated in florida

More help with capital gains. Its called the 2 out of 5 year rule.

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Capital gains and losses are taxed differently from income like.

. Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28. The State of Florida does not have an income tax. Florida does not have state or local capital gains taxes.

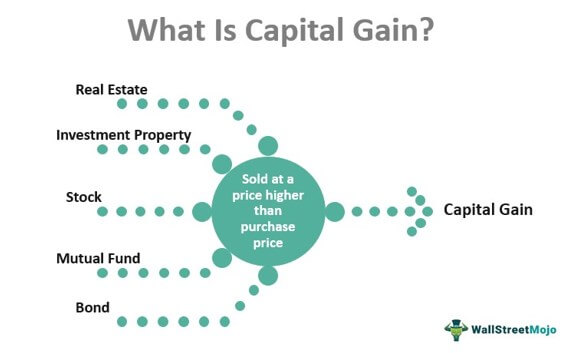

What is capital gains tax and how is it calculated. Special Real Estate Exemptions for Capital Gains. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. However you will still owe federal capital gains tax on. Capital Gains Tax Calculator Tax Type Marginal Tax Rate Effective Tax Rate Tax.

Federal Cap Gains Tax vs. A Florida capital gains tax calculator will help you estimate and pay taxes based on your situation. The rates are 0 15 or.

That means you wont have to pay any Florida capital gains taxes. If you had purchased a 2 bhk in a suburb of Mumbai in the FY year 2005. This also means that there are also no Florida capital gains taxes.

You can use a capital gains tax rate table to manually calculate them as shown. How much is capital gains tax. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Includes short and long-term Federal and State Capital. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

Favorable long-term capital gains tax rates apply only to profits from the sale of assets held for more than a year. Florida Cap Gains Tax. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. 14 hours agoHeres how to calculate your taxable income to harvest tax-free gains. A florida capital gains tax calculator will help you estimate and pay taxes based on your situation.

2022 capital gains tax rates. Calculating how much you need to pay as long term capital gains tax is not very difficult. Capital gains tax is owed when you sell a non-inventory asset at a higher price than you paid resulting in a realized profit.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The state of florida does not have an income tax for individuals and. This means 83350 is taxed at the 0 rate and the couple owes 15 long-term capital gains.

The calculator on this page is designed to help you estimate your. Heres an example of how much capital gains tax. 2021 capital gains tax calculator.

Long-term capital gains tax. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. No capital gains tax is incurred on inventory assets.

Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment. The tax rate you pay on long-term capital gains can be 0 15 or 20.

Florida Real Estate Taxes And Their Implications

Capital Gains Tax Calculator 1031 Crowdfunding

Capital Gain Meaning Types Calculation Taxation

Capital Gains Tax In The United States Wikipedia

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

How Capital Gains On Real Estate Investment Property Works

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Short Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Tax Definition Rates Calculation Smartasset

Crypto Capital Gains And Tax Rates 2022

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Tax On Capital Gains While Receiving Social Security Benefits

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group